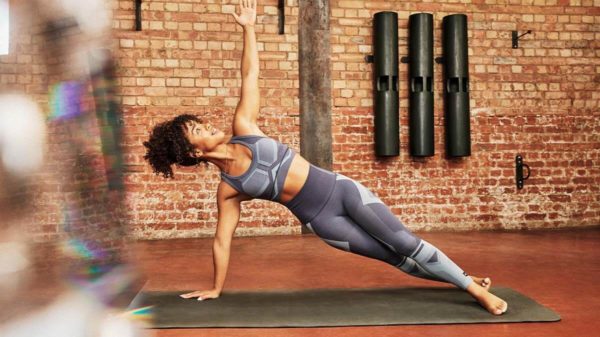

In this digital fitness era, the popularity of the health and fitness industry is growing. However, with the growing popularity, the responsibility to keep all clients safe while enjoying doing gym and achieving fitness goals also grows. The main goal of every gym and fitness business is to keep every patron safe. That is why gym insurance is important for protecting your business and customers in the event of an accident.

Is Gym Insurance Necessary?

Like other businesses, gyms also have legal requirements to have insurance if you are employing staff members. If your gym has employees, it requires employers’ liability insurance to protect the employees in case of any accident or injury. Other than the employer’s liability insurance, you decide to choose the covers you wish to make for your gym business.

How Much Does Gym Insurance Australia Cost?

The cost of gym insurance varies depending on your gym business’s size and the cover you want to include in the policy. If you are only looking for the employer’s liability insurance, then the policy will be relatively cheaper.

While deciding on how much you wish to spend on your private insurance, it’s best to consider how much your business can afford not to be covered by the policy. For most fitness and gym centres, if the policy is huge, it can protect your business from a wide range of risks.

Some covers that you want to include in your gym insurance may slightly increase your insurance cost; however, it will offer great value to your business in the case of an unfortunate accident.

What Can Cover Be Included In Gym Insurance?

One of the most crucial coverages for the gym is public liability insurance. This insurance will cover your business when your customer suffers an injury or has damaged your gym property. Your insurer can cover the compensation and legal fees with public liability insurance if your business is found to be responsible for the damage or injury to your clients.

Another critical cover is the building and content insurance; while thinking of this cover, you need to consider whether you can rebuild your gym and replace gym equipment if your business is damaged. If your business cannot afford it, this cover will keep your business intact even after fire, flood, or vandalism.

Even the business equipment insurance can be a great help to you as your gym has high-tech equipment. This insurance can help you ensure that your gym equipment is in good shape and functioning at all times.

Get the perfect gym insurance for your gym business, and then let your business thrive.